top of page

STAY IN THE KNOW

Tax Tip Tuesday: Tax Impacts of Selling a Home (Both Domestic and Abroad)

Learn the tax implications of selling your home, both in the U.S. and abroad. Understand how the home sale exclusion, depreciation recapture, and foreign tax credits work for U.S. taxpayers.

Nov 42 min read

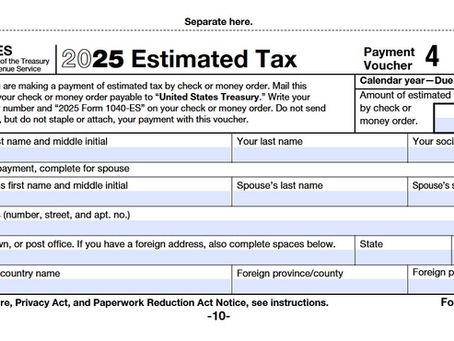

Tax Tip Tuesday: Final Quarter Estimated Tax Tips

The year’s winding down — but before you celebrate, make sure your fourth-quarter estimated tax strategy is solid. Planning now can help you avoid penalties, reduce surprises in April, and keep more of your hard-earned money where it belongs. Know Your Final Payment Deadline The last estimated tax payment for 2025 is due January 15, 2026. You can pay using EFTPS, IRS Direct Pay, or your state’s online payment system (like CA WebPay for California residents). If you file your

Oct 212 min read

Tax Talk Thursday: The IRS Government Shutdown: What It Means and What Taxpayers Can Do

When Congress fails to pass a budget or temporary funding bill, the federal government enters what’s known as a shutdown.

Oct 93 min read

Tax Tip Tuesday: Maxing Out Retirement Before Year-End

As the year winds down, one of the best ways to save on taxes and strengthen your financial future is by maximizing retirement contributions before December 31st.

Oct 73 min read

Tax Tip Tuesday: Medical Expense Deductions – What Qualifies?

When it comes to lowering your taxable income, medical expense deductions can be a valuable tool—but only if you understand what...

Aug 72 min read

Tax Tip Tuesday: Home Office Deduction Tips

Working from home has become the norm for many small business owners, freelancers, and remote employees. If you're using part of your...

Jul 152 min read

Tax Talk Thursday: A Beginner’s Guide to IRS Penalties and Interest

For many taxpayers, the idea of owing the IRS can feel intimidating — and the thought of extra penalties and interest makes it worse. But...

Jul 103 min read

bottom of page