top of page

STAY IN THE KNOW

Tax Tip Tuesday: Living Abroad, Filing at Home: U.S. Expat Tax Essentials — Webinar Recap

This webinar recap breaks down the essentials of U.S. taxes for expats, including worldwide income rules, FEIE vs. FTC, PFIC reporting, FBAR/FATCA requirements, foreign business filings, and state residency issues. Watch the full video and learn how to stay compliant while living abroad.

3 days ago2 min read

Charitable Contributions to U.S. vs. Foreign Organizations: What Counts for Your U.S. Taxes?

When you support a cause you care about—whether it’s disaster relief abroad, an overseas animal rescue, or a global education nonprofit—it’s natural to assume your generosity will also help at tax time.

Dec 43 min read

Webinar Invitation: Living Abroad, Filing at Home — U.S. Expat Tax Essentials

Join me for a clear, practical webinar designed for U.S. expats and anyone with foreign assets. We’ll cover who must file, what income is taxable, key foreign asset reporting rules, and common mistakes to avoid. Perfect for Americans abroad, dual citizens, and global families who want to stay compliant with confidence.

Dec 21 min read

The 6-Year Rule for Unfiled Tax Returns: What It Really Means

Many taxpayers are surprised to learn this: if you never filed a tax return, the IRS can legally go back forever. There is no statute of limitations on unfiled returns. The clock only starts once a return is filed. So why does the IRS talk about a 6-year rule? Because while the IRS can demand every unfiled year, they generally don’t. The 6-year rule is an IRS administrative policy, not a legal limit—but it matters when you’re trying to get back into compliance. No Statute of

Nov 202 min read

Tax Tip Tuesday: Why a Big Refund Isn’t a Win (And What You Should Do Instead)

Getting a big tax refund isn’t a win—it’s a sign you gave the IRS an interest-free loan all year. Learn why refunds drain your cash flow and how smarter withholding keeps more money in your pocket.

Nov 182 min read

Tax Tip Tuesday: Serving and Saving: Tax Benefits Every U.S. Veteran Should Know

Every Veterans Day, we take a moment to honor those who’ve served — and at MKHS Tax Group, we also want to help them make the most of the tax benefits they’ve earned. Whether you’re retired, transitioning out of active duty, or still serving, there are important federal and state tax provisions designed to support veterans and their families.

Nov 112 min read

Tax Tip Tuesday: Tax Impacts of Selling a Home (Both Domestic and Abroad)

Learn the tax implications of selling your home, both in the U.S. and abroad. Understand how the home sale exclusion, depreciation recapture, and foreign tax credits work for U.S. taxpayers.

Nov 42 min read

Tax Talk Thursday: Timing Income and Deductions Across Borders for Tax Efficiency

Learn how timing income and deductions across borders can optimize U.S. and foreign tax outcomes for expats, remote workers, and global entrepreneurs.

Oct 303 min read

Tax Tip Tuesday: Got Paid from Overseas? Don’t Forget These Tax Forms!

If you’ve ever received money from abroad — whether it’s from freelance work, consulting, or royalties — the IRS wants to know. U.S. taxpayers may need to report those payments using Form 1099 (for U.S. payees) or Form 1042-S (for foreign payees).

Oct 281 min read

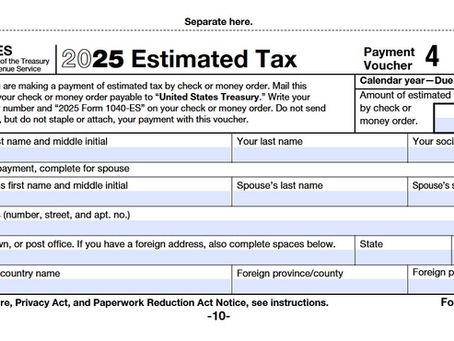

Tax Tip Tuesday: Final Quarter Estimated Tax Tips

The year’s winding down — but before you celebrate, make sure your fourth-quarter estimated tax strategy is solid. Planning now can help you avoid penalties, reduce surprises in April, and keep more of your hard-earned money where it belongs. Know Your Final Payment Deadline The last estimated tax payment for 2025 is due January 15, 2026. You can pay using EFTPS, IRS Direct Pay, or your state’s online payment system (like CA WebPay for California residents). If you file your

Oct 212 min read

Tax Talk Thursday: The IRS Government Shutdown: What It Means and What Taxpayers Can Do

When Congress fails to pass a budget or temporary funding bill, the federal government enters what’s known as a shutdown.

Oct 93 min read

Tax Tip Tuesday: Maxing Out Retirement Before Year-End

As the year winds down, one of the best ways to save on taxes and strengthen your financial future is by maximizing retirement contributions before December 31st.

Oct 73 min read

The Top 10 Uncommon Business Deductions You Might Be Missing

Most business owners know the big-ticket deductions — rent, payroll, and office supplies — but some of the best deductions are hiding in plain sight.

Sep 252 min read

Tax Tip Tuesday: Guide for Freelancers

Freelancing is exciting — you set your own schedule, choose your clients, and work from anywhere. But with that freedom comes a new set of responsibilities, especially when it comes to taxes. Many freelancers wait until April to think about tax season, but staying organized all year long will save you stress and money.

Sep 242 min read

Tax Talk Thursday: Back-to-School Tax Tips for Parents

Back-to-school season isn’t just about backpacks, lunch boxes, and new schedules — it’s also a great time for parents to review their tax...

Sep 113 min read

Tax Tip Tuesday: Digital App Payments - What You Need to Know

In today’s world, digital app payments have become the new norm. Whether you’re sending money to a friend through Venmo, collecting rent via Zelle, or accepting business payments on PayPal or Cash App, these platforms make transactions faster and more convenient.

Sep 92 min read

Tax Tip Tuesday: Deductions vs. Credits – Know the Difference

When it comes to filing your taxes, two common terms often cause confusion: deductions and credits.

Sep 22 min read

Tax Tip Tuesday: What Is Taxable vs. Nontaxable Income?

One of the most common questions taxpayers ask each year is: “Do I really have to report this as income?”

Aug 263 min read

The Hidden Tax Benefits of Home Ownership

For many Americans, buying a home is not just about building equity and having a place to call your own—it’s also a powerful way to unlock hidden tax advantages.

Aug 213 min read

Tax Talk Thursday: Who Wins with the New Tax Bill? Breaking Down H.R. 1 for Individuals and Businesses (Updated)

Congress has officially passed H.R. 1 – the “One Big Beautiful Bill”, and it’s now law. This sweeping tax legislation makes many of the...

Jul 174 min read

bottom of page