top of page

STAY IN THE KNOW

The 6-Year Rule for Unfiled Tax Returns: What It Really Means

Many taxpayers are surprised to learn this: if you never filed a tax return, the IRS can legally go back forever. There is no statute of limitations on unfiled returns. The clock only starts once a return is filed. So why does the IRS talk about a 6-year rule? Because while the IRS can demand every unfiled year, they generally don’t. The 6-year rule is an IRS administrative policy, not a legal limit—but it matters when you’re trying to get back into compliance. No Statute of

Nov 202 min read

Tax Tip Tuesday: Why a Big Refund Isn’t a Win (And What You Should Do Instead)

Getting a big tax refund isn’t a win—it’s a sign you gave the IRS an interest-free loan all year. Learn why refunds drain your cash flow and how smarter withholding keeps more money in your pocket.

Nov 182 min read

Tax Tip Tuesday: Got Paid from Overseas? Don’t Forget These Tax Forms!

If you’ve ever received money from abroad — whether it’s from freelance work, consulting, or royalties — the IRS wants to know. U.S. taxpayers may need to report those payments using Form 1099 (for U.S. payees) or Form 1042-S (for foreign payees).

Oct 281 min read

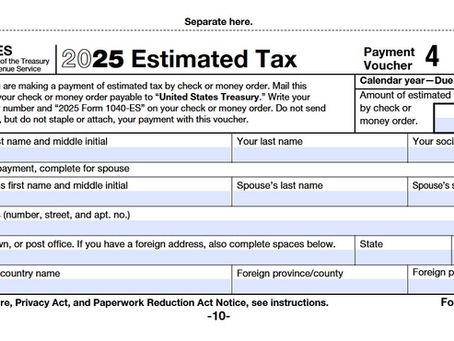

Tax Tip Tuesday: Final Quarter Estimated Tax Tips

The year’s winding down — but before you celebrate, make sure your fourth-quarter estimated tax strategy is solid. Planning now can help you avoid penalties, reduce surprises in April, and keep more of your hard-earned money where it belongs. Know Your Final Payment Deadline The last estimated tax payment for 2025 is due January 15, 2026. You can pay using EFTPS, IRS Direct Pay, or your state’s online payment system (like CA WebPay for California residents). If you file your

Oct 212 min read

Tax Talk Thursday: The IRS Government Shutdown: What It Means and What Taxpayers Can Do

When Congress fails to pass a budget or temporary funding bill, the federal government enters what’s known as a shutdown.

Oct 93 min read

Tax Tip Tuesday: Maxing Out Retirement Before Year-End

As the year winds down, one of the best ways to save on taxes and strengthen your financial future is by maximizing retirement contributions before December 31st.

Oct 73 min read

The Top 10 Uncommon Business Deductions You Might Be Missing

Most business owners know the big-ticket deductions — rent, payroll, and office supplies — but some of the best deductions are hiding in plain sight.

Sep 252 min read

Tax Tip Tuesday: Digital App Payments - What You Need to Know

In today’s world, digital app payments have become the new norm. Whether you’re sending money to a friend through Venmo, collecting rent via Zelle, or accepting business payments on PayPal or Cash App, these platforms make transactions faster and more convenient.

Sep 92 min read

Tax Talk Thursday: Who Wins with the New Tax Bill? Breaking Down H.R. 1 for Individuals and Businesses (Updated)

Congress has officially passed H.R. 1 – the “One Big Beautiful Bill”, and it’s now law. This sweeping tax legislation makes many of the...

Jul 174 min read

Tax Tip Tuesdays: When Should You Amend Your Tax Return?

Nobody loves doing their taxes twice — but sometimes it’s necessary.

Jul 12 min read

Tax Talk Thursdays: Common Tax Traps for U.S. Expats—and How to Avoid Them

Common Tax Traps for U.S. Expats—and How to Avoid Them

May 83 min read

bottom of page