top of page

EXPERT TAX TIPS - STAY IN THE KNOW

Tax Tip Tuesday: Tax Impacts of Selling a Home (Both Domestic and Abroad)

Learn the tax implications of selling your home, both in the U.S. and abroad. Understand how the home sale exclusion, depreciation recapture, and foreign tax credits work for U.S. taxpayers.

Nov 4, 20252 min read

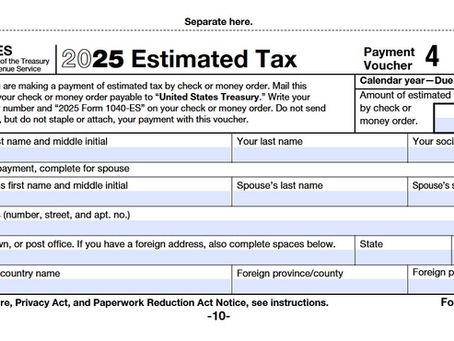

Tax Tip Tuesday: Final Quarter Estimated Tax Tips

The year’s winding down — but before you celebrate, make sure your fourth-quarter estimated tax strategy is solid. Planning now can help you avoid penalties, reduce surprises in April, and keep more of your hard-earned money where it belongs. Know Your Final Payment Deadline The last estimated tax payment for 2025 is due January 15, 2026. You can pay using EFTPS, IRS Direct Pay, or your state’s online payment system (like CA WebPay for California residents). If you file your

Oct 21, 20252 min read

Tax Talk Thursday: The IRS Government Shutdown: What It Means and What Taxpayers Can Do

When Congress fails to pass a budget or temporary funding bill, the federal government enters what’s known as a shutdown.

Oct 9, 20253 min read

Tax Tip Tuesday: Maxing Out Retirement Before Year-End

As the year winds down, one of the best ways to save on taxes and strengthen your financial future is by maximizing retirement contributions before December 31st.

Oct 7, 20253 min read

Tax Tip Tuesday: Medical Expense Deductions – What Qualifies?

When it comes to lowering your taxable income, medical expense deductions can be a valuable tool—but only if you understand what qualifies. Many taxpayers miss out simply because they don’t realize which costs can be deducted or how to claim them properly. To deduct medical expenses, you must itemize your deductions on Schedule A (Form 1040). You can only deduct the portion of your unreimbursed medical expenses that exceeds 7.5% of your adjusted gross income (AGI). For exampl

Aug 7, 20252 min read

Tax Tip Tuesday: Home Office Deduction Tips

Working from home has become the norm for many small business owners, freelancers, and remote employees. If you're using part of your home regularly and exclusively for business, you may qualify for the home office deduction — and it can be a valuable tax-saver. Let’s break down some tips to help you make the most of this deduction: 1. Understand Who Qualifies To claim the home office deduction, your home office must be: Used regularly and exclusively for business (no persona

Jul 15, 20252 min read

Tax Talk Thursday: A Beginner’s Guide to IRS Penalties and Interest

For many taxpayers, the idea of owing the IRS can feel intimidating — and the thought of extra penalties and interest makes it worse. But...

Jul 10, 20253 min read

bottom of page